Friends, If you are an investor in the share market you must know how to calculate WACC in Mero Share? In this article, I will show you how you can calculate the WACC of your share on your Mero Share easily.

WACC: Introduction, Significance, and Background

WACC (भारित औशत लागत गणना) stands for Weighted Average Cost of Capital. You cannot transfer the share you sell through your NEPSE TMS without doing WACC. It can be understood as a kind of tax that should be deducted from the share's value if it is gaining profit. 5% capital gain tax must be paid to the government by doing WACC.

You must transfer the sold shares within the 3 days of the sale. If not transferred you could be penalized. Hence, doing WACC is very important in the share market. You can do WACC easily through Mero Share. But before you had to visit the broker now all the systems moved online and it became handy.

When someone wants to sell his/her share, then he/she has to calculate WACC in Mero Share before transferring the shares to the buyers. It's quite a simple and short process in Mero Share.

Knowing the Concept of WACC

It is quite a lengthy and complex or expertized task to calculate WACC manually but you can easily calculate WACC in Mero Share in a few clicks.

However, you have to know the manual process of the calculation to know about WACC from the nearest view.

Let's know it through an example,

If you purchase 100 units of shares in 2010 at Rs. 300 per unit and again you purchased 100 units of shares in 2015 at Rs. 400. Then, when you wish to sell the 100 units of the share in 2020 at Rs. 500 you have to calculate WACC.

You have to calculate the WACC of every share you want to sell. For that, it calculates the average price of the shares purchased at different prices.

Suppose the average of the above-purchased shares (shares purchased in 2010 and 2015) is 450 then a 5% capital gain tax is deducted if it is being sold above the average price i.e Rs 450 otherwise not.

BUT IN MEROSHARE you do not have to bother yourself to calculate all these averages and percentages. You just have to follow a few steps.

How to Calculate WACC in Mero Share?

Calculating WACC in Mero Share is quite easy and short process. You do not have to go through manual forms and calculation after SEBON has enforced online system to calculate WACC through Mero Share. In the below section I am going to show you how to calculate WACC in Mero Share?

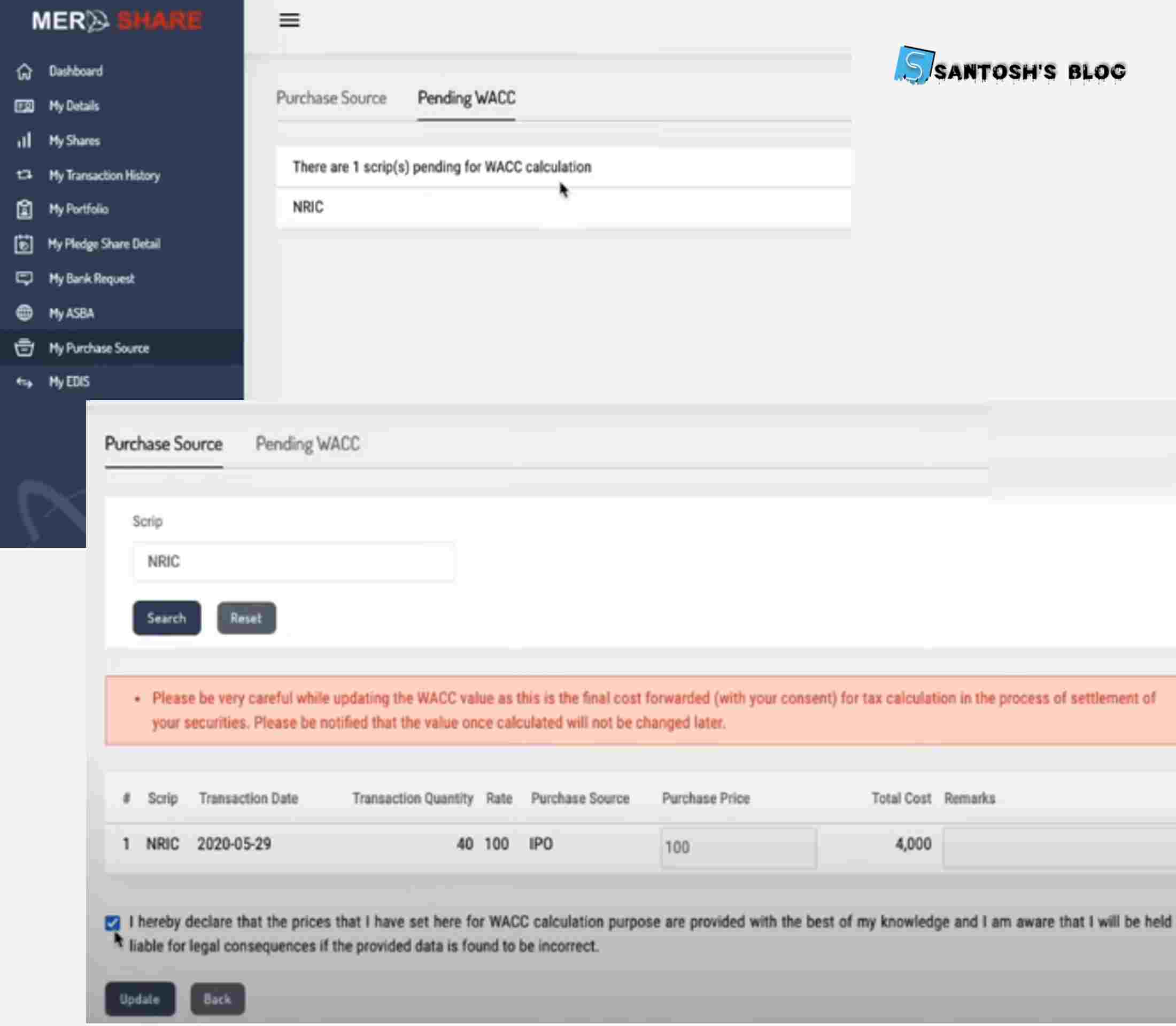

- Open your Mero Share and log in to your DP.

- Go to My Purchase Source.

- There you will see Purchase Source and Pending WACC.

- Select Pending WACC.

- Click on the Share for which you want to calculate WACC.

- Checkmark the share and all the terms and conditions after reading them carefully as shown in the picture above. You must verify the information shown for your shares like per-unit price and others are correct. If not set the price you have paid for the share in the price box and submit the bill number of the share purchase receipt from the broker in the remarks as proof.

- After going through all these steps click on update or proceed.

Watch this video to be more clear on How to Calculate WACC in MeroShare?

Video regards- Nepali Online Share Market Youtube Channel

I hope you understood the steps to calculate WACC in Mero Share. These are the simple steps that you can follow to calculate the WACC of your share which you want to sell and transfer to the buyer's DEMAT.

Just for you,

0 Comments

Post a Comment

All the information shared here are the outcome of author's research and experience, they might not be applicable in your particular case. Therefore before applying such crucial matters in your personal life don't forget to understand the acutal sutiation. In the other hand we try to provide genuine, validated and tangible information to you.

Please be polite and don't forget to follow the community guidelines while commenting in the post. We don't allow the spam comments in our blog.